In many ways, Africa has been shaped by its contact with the world’s colonizing powers, from the Phoenicians of antiquity to Europeans of the modern age. While the marks they have left are many and varied, one you might not have considered is money.

An Introduction to Money

For many Americans it is hard to imagine life without our credit cards, much less without the institution of money. But did you know that for most of its 6,000-year history (from the start of the predynastic era c. 5300BCE to the end of the Roman era c. 400CE), the Egyptian economy was based on food rather than money? In fact, money as we know it was probably not minted until around 600BCE.[1]

CFA Francs

By the mid-19th century, France had considerable sovereignty in Africa. From 1910 and the establishment of the federation of France’s central African colonies known as French Equatorial Africa, the money of choice in these colonies was the French Equatorial Franc. A counterpart currency for France’s West African colonies was the West African franc. These currencies lasted until 1945 when they were replaced with CFA francs – the Central African CFA franc (XAF) and the West African CFA franc (XOF). Conveniently enough, they are of equal value.

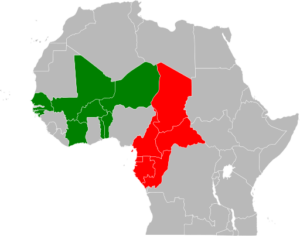

As France’s African colonies gained their independence, most chose to retain the CFA franc. Countries which use the XAF today are Cameroon, Gabon, Republic of the Congo, Chad, Central African Republic, and Equatorial Guinea, a formerly Spanish colony that adopted the XAF in 1984, after joining the Customs and Economic Union of Central Africa.[2] Those who use the XOF are Benin, Burkina Faso, Côte d’Ivoire, Mali, Niger, Senegal, Togo, and the former Portuguese colony Guinea-Bissau who adopted the XOF in 1997.[3]

Financial Freedom

While the former colonies are now sovereign, they remain fiscally dependent on France. So much so, in fact, that CFA countries (or the “franc zone”) are required to keep half of their foreign reserves with the French treasury yet have no say in fiscal policy, a further point of contention.

Critics have asserted that African savings were subsidizing French public spending or that they could have been invested in better assets.

– Francisco Perez, Executive Director of the Center for Popular Economics

Proponents, on the other hand, cite the benefits of remaining tied to the French economy, namely the stability of a fixed exchange rate, currently tied to the Euro, that helps to control inflation. They contend that said stability lends countries in the franc zone a degree of visibility in the financial world they would otherwise lack. Critics, on the other hand, view the treaties pegging the CFA franc to the Euro via France to be restraining rather than beneficial. They contend that these policies restrict credit to local economies and overvalue the currency itself. This overvaluation is especially detrimental to competitive trade agreements, especially now while so many countries of the franc zone are working hard to transform themselves into more robust, middle-income economies.

Regardless of who is right, some form of monetary union … has many advantages in terms of economic stability and governance

– Casimir Oyé Mba, Former governor of the Banque des États de l’Afrique Central

As the nations of Central and West Africa seek to stand on their own financial feet, institutions such as the Economic Community of West African States (ECOWAS) are inspired by the Euro and are working toward the implementation a single currency used in their member states. In fact, the eco is planned to be released in 2027.

Want to Know More?

Check out These Articles: The pros and cons of the CFA franc zone

[1] http://rg.ancients.info/lion/article.html

[2] https://www.investopedia.com/terms/c/central-african-cfa-franc-xaf.asp